QNE

LHDN E-INVOICE

SOLUTION

QUICK | EASY | COMPLIANT

QUICK | EASY | COMPLIANT

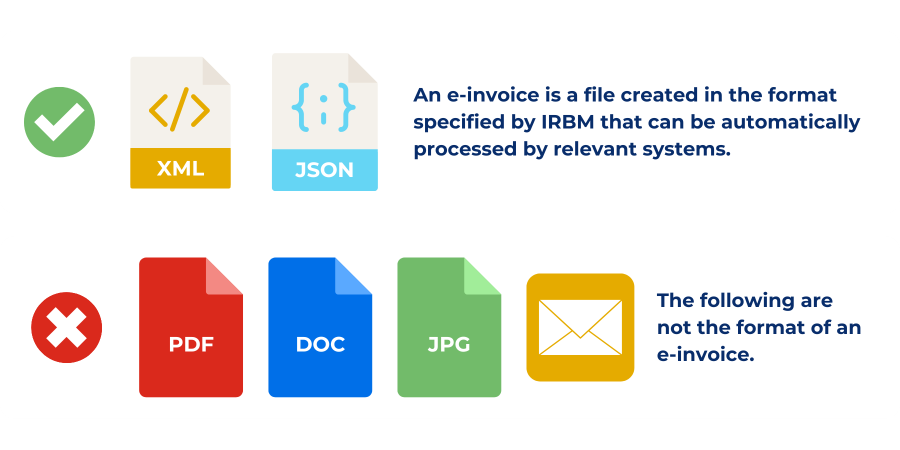

An LHDN e-invoice is a digital representation of a transaction between a supplier and a buyer. e-Invoice replaces paper or electronic documents such as invoices, credit notes, and debit notes.

An e-invoice contains the same essential information that records transaction data for daily business operations.

WHO ARE REQUIRED TO ISSUE E-INVOICE?

B2B, B2C, and B2G

Book a FREE consultation with our team by filling out the information below to schedule your online demo appointment.

** Please state your preferred date and time in the message box below.

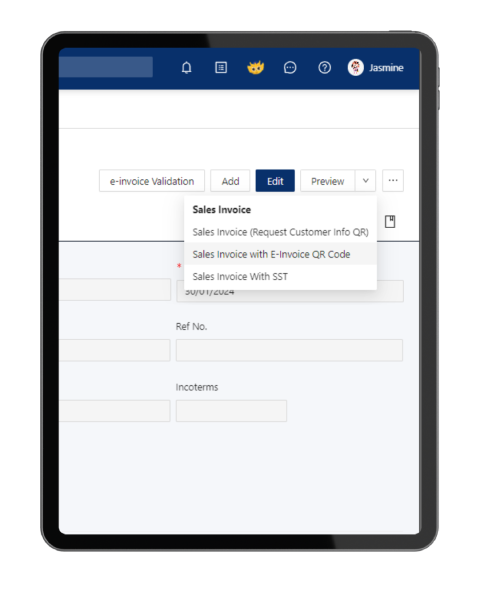

Generate e-Invoices effortlessly with QNE AI Cloud Accounting or QNE Hybrid Cloud Accounting. With just a click, you can submit your invoice to LHDN for validation, ensuring compliance and saving you time. Enjoy streamlined processes, increased accuracy, and enhanced efficiency.

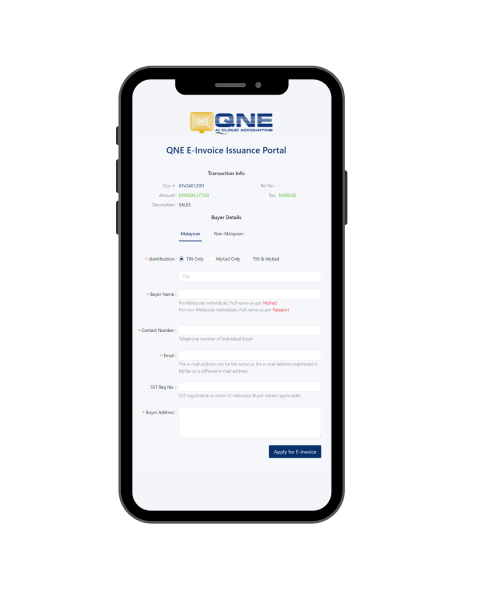

When the buyer requests an e-Invoice at the time of the transaction, obtaining their tax information can be time-consuming. With QNE E-Invoice solutions, we offer a simpler and more efficient way to collect your buyer’s tax information using a QR code. This ensures that the tax information is accurate and saves you time.

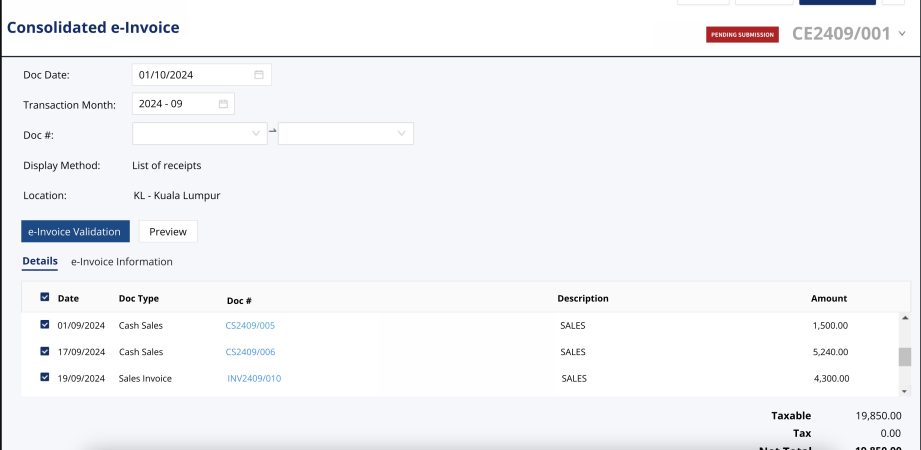

Businesses dealing with B2C transactions can also generate consolidated e-invoices using QNE AI Cloud Accounting and QNE Hybrid Cloud Accounting. At the end of every month, you can generate consolidated e-invoices from your cash sales transactions. With a single click, these invoices will be consolidated and submitted to LHDN for validation.

What makes the QNE E-Invoice solution even more powerful is that customers can simply scan the QR code printed on the standard invoice and enter their details to request an e-Invoice, making the process even simpler. Once customers fill in their details and submit the request, it will proceed to LHDN for validation automatically. You will be notified when your buyer has requested and submitted an e-Invoice request.

Self-billed e-Invoices can be especially challenging for businesses involved in high-volume operations, such as purchasing goods or services from foreign suppliers or ordering on e-commerce platforms, or those with varied expenses like commissions to agents, dealers, or distributors. Additionally, you may overlook some purchase transactions that lack corresponding e-invoices, rendering them disallowed for tax claims.

The QNE E-Invoice solution transforms this tedious task into an effortless process. By automatically transferring details from purchase invoices and payment vouchers to self-billed e-Invoices, it eliminates the need for manual entry, saving you valuable time and reducing errors. Simplify your invoicing and ensure compliance with tax regulations using QNE E-invoice.

See how QNE AI Cloud Accounting can help you have a seamless transition with the LHDN e-invoice implementation:

Skip the hassle of preparing LHDN e-invoice manually with QNE AI Cloud Accounting. Collect, organize, and generate LHDN e-invoice in an instant for a quick and easy compliance.

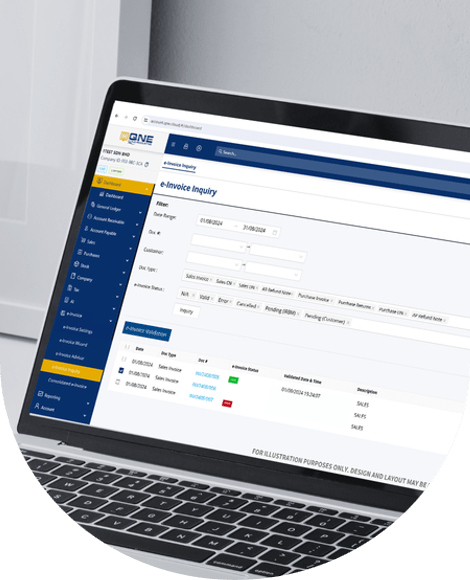

e-Invoice Inquiry

Check the status of LHDN e-invoices inputted in the QNE AI Cloud Accounting Software. Missing e-invoice details? Customers can simply scan the QR code on the printed receipt from QNE AI Cloud Accounting and enter their details to request for an e-invoice.

e-Invoice Validation

No need to switch tab in order to submit LHDN e-invoice! QNE AI Cloud Accounting has e-invoice validation that lets you submit and validate e-invoice on every transaction screen ensuring fast and accurate data.

Consolidated e-Invoice

Simplify your monthly routine by consolidating all cash sales and invoices. Submit your consolidated e-Invoice effortlessly and review transactions even after submission!

Embrace the implementation of LHDN e-invoice with ease with QNE AI Cloud Accounting’s e-invouce Wizard. Be guided on the step-by-step procedure on how the e-invoice module works.

Embrace the implementation of LHDN e-invoice with ease with QNE AI Cloud Accounting’s e-invouce Wizard. Be guided on the step-by-step procedure on how the e-invoice module works.